Private Equity Accelerating into the Digital Age

by Anthony D. Harvey

“Don’t worry, be happy” While the rest of Europe is scrambling to deal with political fragmentation, the great unknown Brexit, and a proliferation of “forget globalization, make my country greater than yours”, Private Equity is getting on with investing in the digital future. It has already taken on board that digitization is central to growth and promises golden opportunities.

“Eighty seven percent of senior business leaders say that digitalization is now a priority and in many cases is a do-or-die imperative.” (Gartner, HBR Nov18)

A sizeable portion of newer acquisitions tend to be enterprises that are already digital and agile. The indicators for why they are such attractive investments are quite persuasive.

“… the 10% of companies regarding themselves as ‘digital-first’ were 64% more likely to exceed their top 2018 business goals by a significant margin” (2019 Digital Trends Report, Adobe & Econsultancy)

What about the non-digital rest?

There still seem to be plenty of more traditional or hidden champions around, where a PE with a ‘nose’ for a great deal can sniff out potential for high growth. So, it’s certainly also worth having a close look at the digital potential of these companies, who are likely to have heard this ‘wake-up’ call too.

“…more than 66% of CEOs said they expect their companies to change their business model in the next three years, with 62% reporting they have management initiatives or transformation programs underway.” (Gartner, HBR Nov 2018)

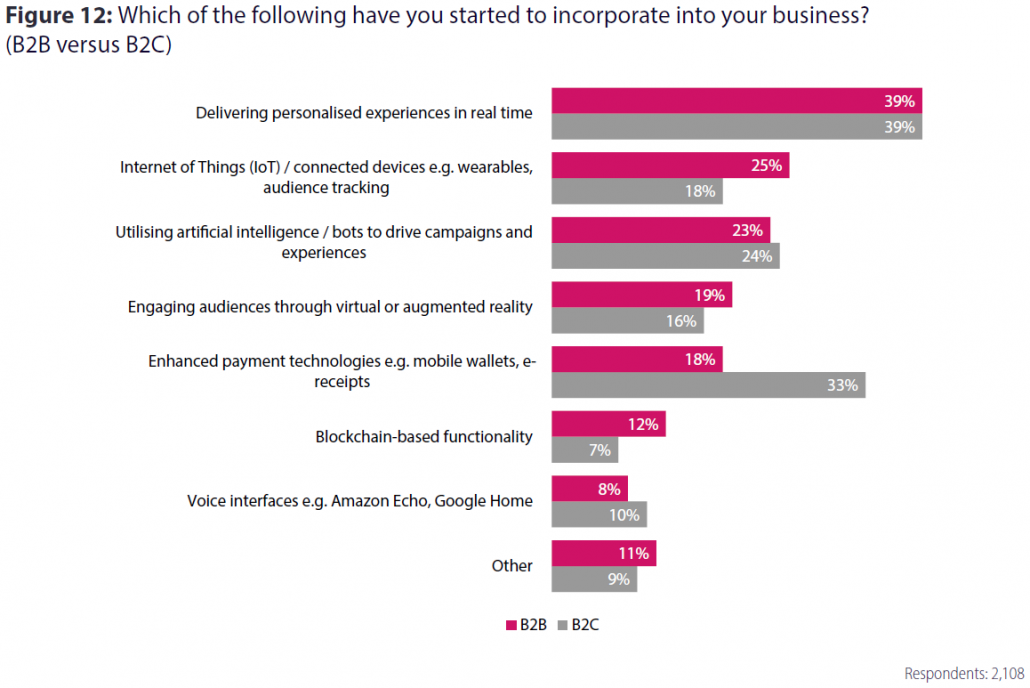

So, what is management working on as their first digital priorities to make their ambitious financial plans? Well there seems to be a high degree of overlap between technology and people thrusts, as reliable data shows:-

(2019 Digital Trends Report, Adobe & Econsultancy 12,815 respondents)

At the moment, two mega-drivers are making these digital strategies financially viable, namely the increased availability of high-speed fibre networks and the imminent explosion of 5G technology.

Transformation in the portfolio also means change

In the not too distant past, during the Operational Excellence wave, companies were focussed on the efficiency of their operating and marketing processes. Today, an impact checklist that a investment manager might use to drive transformation in a portfolio company may look a bit different:

- how are customers treated and how do they interact with the company?

- how does the company monitor and react to events and the market?

- how flexibly do staff, management and board interact and work together?

- how are suppliers treated and aligned with the company platform?

- how resilient is the company in complying with changed governance regulations and serving shareholder agendas like sustainability?

Digitalization of core business processes will definitely improve performance and enhance customer experience. Agility will ensure that products, technologies and platforms flex to match market demand and deter customers from moving elsewhere.

The investment logic for digitalization is sound

A company that truly makes the most of the digital world will have everything connected: technology & data, people & processes, culture & vision, strategy and change management. Therefore, a key part of PE due diligence today is the assessment of this digital readiness, and the availability of measures to track further innovations during the growth hold period.

Specifically, recognising and realising the digital transformation potential requires clear top-down strategic planning. Boards and management must be prepared and open for real change, and they must put the building blocks in place to bring this about throughout the company. One of the mandates that Private Equity has is to ensure that the board shares a future digital vision and culture with the investment team.

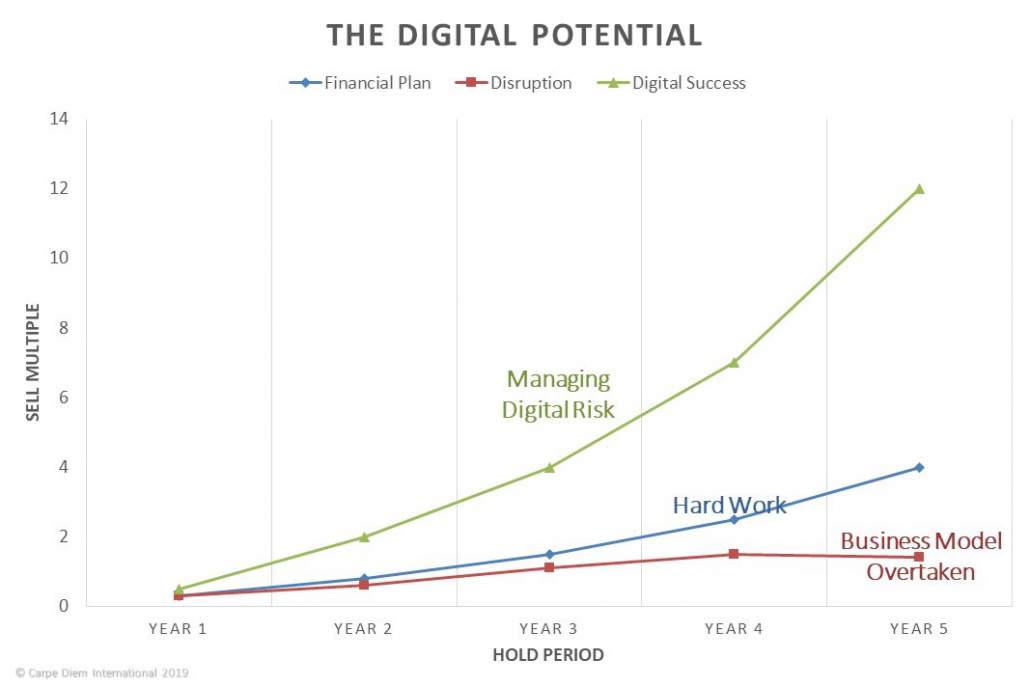

A digitally fit company will be in the optimum position to retain and attract customers, staff and investors, and to maximize profits. They are more likely to exceed their business plan and offer an enhanced return at exit. Those who ignore or half-heartedly follow digital opportunities will have an uphill battle to meet their growth plans

The leverage for digitalization rests in the hands of savvy founders, directors, managers and staff. Consequently, when assessing the critical success factors of a company, the digital competency of the Leadership and Financial team must be quantifiably understood.

Front-runner companies tend to look like this

A digitally aware Board is in place with a forward-looking view that directs management to master the challenges of a digital world. Digital strategy, values, risk, and business model drive the growth plan.

Company resources are focused on introducing appropriate digital technologies that deliver satisfying customer experiences to capture more share at higher margins, using innovative market platforms driven by data analytics and machine intelligence.

The company is run by digitally fit leaders who involve people that embrace agile methods, mind-sets and ways-of-working. Their solutions are resilient to withstand the continuous challenge of exceeding expectations in a disruptive global market.

The financial plan and actual results confirm the fast track growth of the investment which is exceeding goals and surprising the investment community with its innovations.

There are some challenges, of course

Often the founders and executives at fast-growing digital company are tightly focused on product, technology, and customer. As they grow, they discover that they are anything but expert at conventional professional management methods, structures, regulations and financial strategies, and the rest of that ‘boring’ growth stuff. These qualities may need to be learned from the investment team or hired external advisors.

Finally, looming on the horizon is the topic of Sustainability – the best of the best have already embraced this and turned it into a competitive edge, streets ahead of others who are still discussing the need. A strong innovation culture coupled with a forward-looking Risk Management System are the paramount competencies to look for here.

The questions you should be asking and answering yourselves

There are three questions for investment institutions to ask themselves that will prompt proper debate about how important digital opportunities are for the investment strategy, and how capable an institution is of mastering digital momentum:

- What could you do differently in origination and due diligence to identify and quantify digital upsides and risk?

- What could you be doing differently with your Portfolio companies to encourage additional growth through appropriate digitization or more agility?

- Reflecting on the yardstick you apply to target investments, what could you do digitally differently with your own internal processes?

The imperative for digitizing intelligently

Digitalization is surely relevant to every business today to a greater or lesser degree. Intelligent decisions about digitalization depend on the type of business model and platform, and the business’s product or service. Failures have exposed the reality that customers will not simply buy a digital solution if there is no real need.

Private Equity and Investment Funds should already have an understanding of their appetite and capability towards digitization, and have aligned their origination, transaction and portfolio teams on the fund strategy.

Establishing digital positioning of a target or portfolio company, and mapping it into a digital & agile mobility (maturity) index, will guide immediate development priorities.

If a company fails to keep up with digital trends and corporate digitalization, it will be handing a huge advantage to its competitors that do so. Private Equity is doing its part in ensuring that this doesn’t happen on their turf.

Tony Harvey

November, 2019